Financial Requirements of the 1031 Exchange

First, let’s understand the difference between a realized gain and a recognized gain. A realized gain is taking your net sales price on your property and subtracting your adjusted tax basis from that number. If the difference is positive, you have a realized gain. A recognized gain is a taxable portion of the realized gain. Most taxpayers doing 1031 Exchanges desire to limit their recognized gain to an insignificant amount or to have no recognized gain at all.

To meet the financial requirement of the 1031 Exchange to limit your realized gain, you must follow the following steps:

-

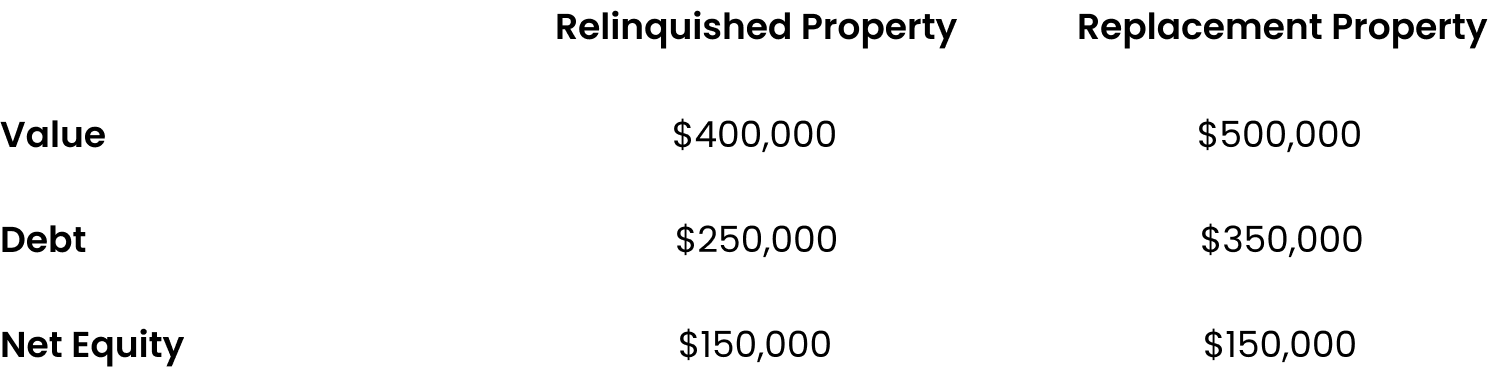

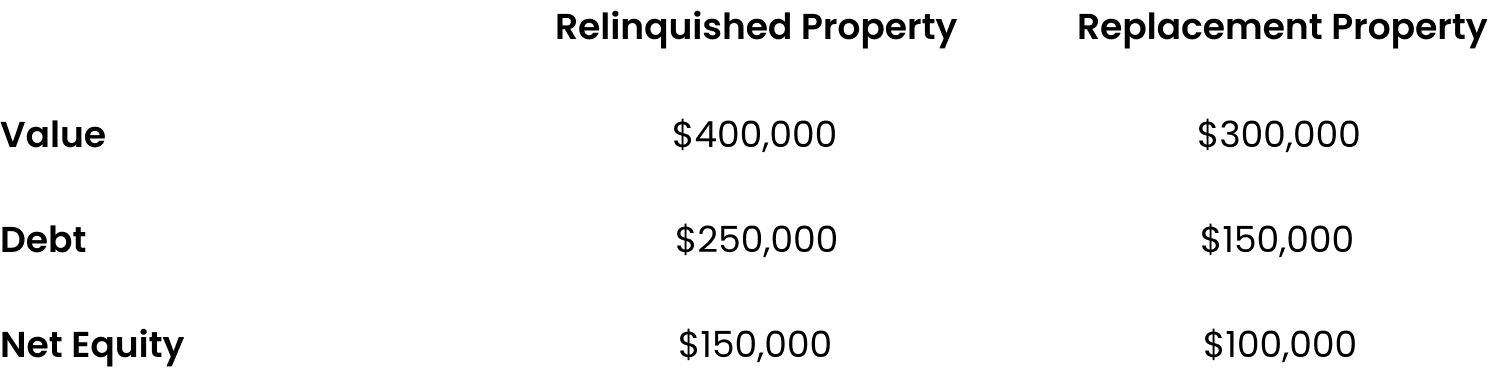

Acquire replacement property that is equal or greater in value than the relinquished property;

Reinvest all of net equity from the relinquished property as down payment on your replacement property (you can also pay allowable closing costs with these funds); and

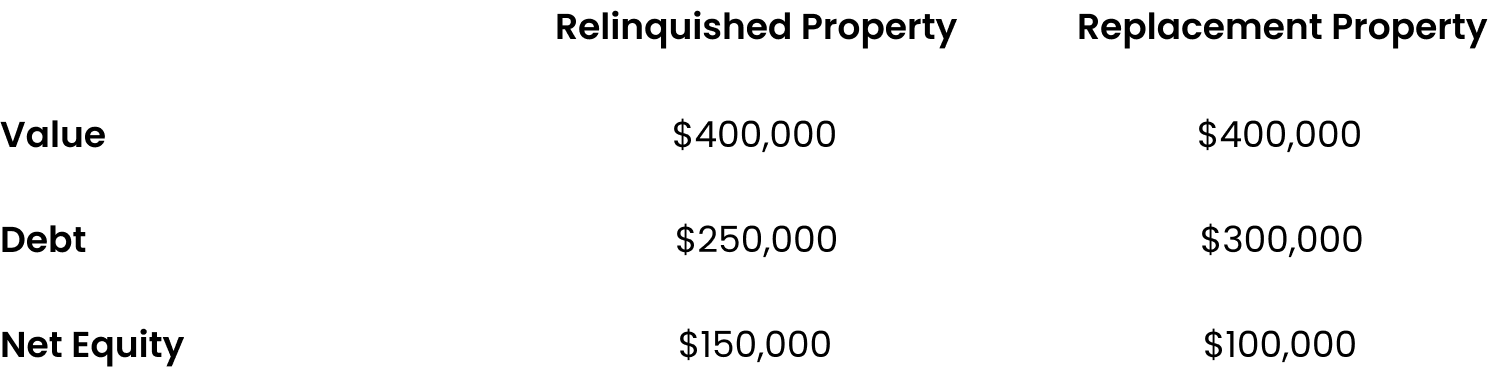

If there was debt on the relinquished property, you must acquire new debt equal or greater on your replacement property (or you can replace debt with an additional out of pocket cash deposit).

If a taxpayer does not meet the above requirements, they will have taxable “boot”. There are two types of boot; “cash boot” or “mortgage boot”. Cash boot is when a taxpayer does not spend all of their net cash from the sale as down payment on the replacement property. Mortgage boot (or relief of debt) is a lowering in the taxpayer’s mortgage liability. In either case, the client will have a recognized gain on the amount and will have a capital gain.